when will capital gains tax increase be effective

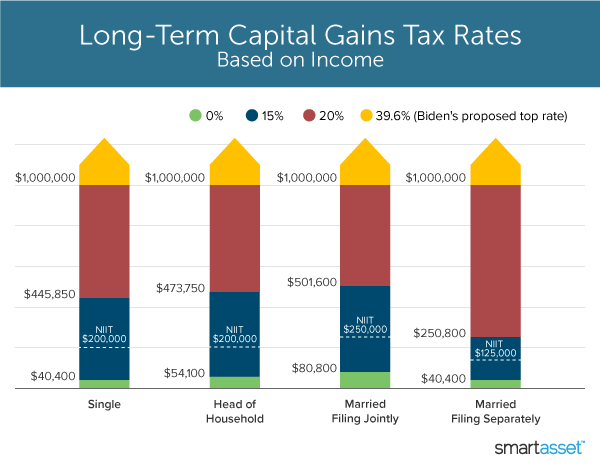

Capital gains are taxed at different rates depending on your tax bracket and how long youve held a security. The 20 rate is not reached for individuals until 400000 single and 450000 married filing joint and the 38 tax does not apply until 200000250000 of AGI.

2021 And 2022 Capital Gains Tax Rates Forbes Advisor

The highest in the OECD at 627 percent see Figure 3.

. Federal income tax on the net total of all their capital gainsThe tax rate depends on both the investors tax bracket and the amount of time the investment was held. Not only can you deduct the fair market value of what you give from your income taxes you can also minimize capital gains tax. The maximum long-term capital gains and ordinary income tax rates were equal in 1988 through 1990.

Gains in excess of 11950 in 2013 are taxed at 20 plus the 38 Medicare tax. The built-in gains tax applies to C corporations that make an S corporation election and it can be assessed during the five-year period starting with the first tax year for which the S election is effective. So trapping capital gains in the trust will often increase the intra-family taxes.

Fill out your gains and losses in their respective lines. In 2019 to 2029 the trust has gains of 7000 and no losses. The estate value would be reduced by the capital gains tax paid.

The heirs would increase the basis by the gains ie their basis would be market value at time of death the same as under present law. In 2020 the capital gains tax rates are either 0 15 or 20 for most assets held for more than a year. 129 Subject to 130 and 1301 the capital gains referred to in 127 do not include the portion of capital gains that arise on the disposition of shares that is attributable to an increase to the cost of the shares that was denied by either of subclause.

Effective for tax years beginning on or after January 1 2002 the Massachusetts Legislature enacted changes regarding the income tax treatment of capital gains and losses under chapter 62 of the General Laws. And tax capital gains at that time. The tax brackets for each province vary so you may be paying different amounts of capital gain tax depending on which province you live in.

You live in it for the first year rent the home for the next three years and when the tenants move out. For most capital gains and losses youll need to fill out Form 8949 and Schedule D in addition to Form 1040. This means that if you earn 2000 in total capital gains then you will pay 53520 in capital gains tax.

In the United States of America individuals and corporations pay US. How To Report Capital Gains and Losses. Tax Foundation is Americas leading independent tax policy resource providing trusted nonpartisan tax data research and analysis since 1937.

If your gains are more than your losses you may have to pay a capital gains tax. Short-term capital gains are taxed at the investors ordinary income tax rate and are defined as investments held for a year or less before being sold. This argument is flawed.

Capital gains tax strategies You can use charitable contributions to reduce your capital gains tax liability by donating long-term appreciated assets. A capital losswhen a security is sold for less than the purchase pricecan be used to reduce the tax burden of future capital gains. The estate taxs average effective rate of.

If you sell a security that youve held for more than a year any resulting capital gains are considered long-term and are taxed at lower rates than ordinary income. 13 2021 and will also apply to Qualified Dividends. The capital gains tax rate is no more than 15 for most individuals and some or all of net capital gain may be taxed at 0 if taxable income is less than 83350 as of 2022.

Since 2003 qualified dividends have also been taxed at the lower rates. Personal Income Tax I. Conversely short-term capital gains are taxed as ordinary income.

This new rate will be effective for sales that occur on or after Sept. The maximum capital gains are taxed would also increase from 20 to 25. The capital gains tax allowance in 2021-22 is 12300 the same as it was in 2020-21.

Individuals paid capital gains tax at their highest marginal rate of income tax 0 10 20 or 40 in the tax year 20078 but from 6 April 1998 were able to claim a taper relief which reduced the amount of a gain that is subject to capital gains tax thus reducing the effective rate of tax depending on whether the asset is a business asset or a non-business asset and the length. Suppose you purchase a new condo for 300000. The capital gains tax rate in Ontario for the highest income bracket is 2676.

Theres no Capital Gains Tax to pay and unused losses of 3000 to carry forward to 2020 to 2021. Higher-income individuals may pay capital gains tax at 20 if their taxable income exceeds a threshold depending on their filing status. However a 28 percent federal corporate income tax rate combined with Bidens proposal to tax long-term capital gains and qualified dividends at an ordinary income tax rate of 396 percent for income earned over 1 million would make the top integrated tax rate on corporate income in the US.

The maximum capital gains are taxed would also increase from 20 to 25. This new rate will be effective for sales that occur on or after Sept. The capital gains tax rates typically apply to nearly all capital gains income whereas the estate tax applies only to the part of an estate that exceeds the exemption level.

13 2021 and will also apply to Qualified Dividends. How the Capital Gains Tax Works With Homes. For most of the history of the income tax long-term capital gains have been taxed at lower rates than ordinary income figure 1.

MAXIMUM TAX RATE ON CAPITAL GAINS. What is the capital gain tax for 2020. Proposals to tax capital gains at death date back to President.

The purpose of this Technical Information Release TIR is to explain the.

Sales Taxes In The United States Wikipedia The Free Encyclopedia Capital Gains Tax Sales Tax Tax

Capital Gains Tax Spreadsheet Shares Capital Gains Tax Capital Gain Spreadsheet Template

What Is Gearing Strategy Of Borrowing Money To Invest Https Www Mywealth Commbank Com Au Learn Choosing In Investing Investing Money The Borrowers

Pin By Diane Cecere On Important Information Virtual Currency Irs Taxes Capital Gains Tax

Capital Gains Yield Cgy Formula Calculation Example And Guide

An Income Tax Flowchart From My Tax Notes All About Scholarships Related Scholarships Paying Taxes Flow Chart

Federal Revenue From Capital Gains Taxes Fell Sharply During The Recession Down 100 Billion From 2007 To 2009 Rates Are Capital Gain Capital Gains Tax Gain

What S In Biden S Capital Gains Tax Plan Smartasset

Biden S Plan Raises Top Capital Gains Tax Rate To Among Highest In World

Chart The Downward Spiral In Interest Rates During The Onset Of An Economic Crisis National Governments Interest Rate Chart Interest Rates Financial Wealth

Harpta Maui Real Estate Real Estate Marketing Taxact

Proposed 2022 Tax Changes In 2021 Business Tax Financial Coach Capital Gains Tax

20 Big Profitable Us Companies Paid No Taxes Company Symbol Us Companies Thermo Fisher

At The Same Time That Their Incomes Have Grown Effective Tax Rates On The Super Super Rich Have Fallen Especially Since Ou Stock Market Graphing Capital Gain

Iasbaba S Mind Map Gaar Changes In Tax Treaties Issue 25th January Mind Map Mindfulness Map