maryland earned income tax credit 2019

Office of the Comptroller. Ad Answer Simple Questions About Your Life And We Do The Rest.

File With Confidence Today.

. Applying the Act to taxable years beginning after December 31 2018. Allowing certain individuals to claim a refund of the credit. Maryland sb719 2020 altering the calculation of the maryland earned income tax credit to allow certain individuals without qualifying children to claim an increased credit allowing certain individuals to claim a refund of the credit applying the act to taxable years beginning after december 31 2019 etc crossfiled bill a classlink bold.

To be eligible for the federal and Maryland EITC your federal adjusted gross income and your earned income must be less than the following. Expanding the eligibility of the Maryland earned income tax credit to allow certain individuals without qualifying children to claim the credit. And applying the Act to taxable years beginning after.

50162 55952 married filing jointly with three or more qualifying children 46703 52493 married filing jointly with two qualifying children. This might vary some for the 2019 requirements. Expanding the eligibility of the Maryland earned income tax credit to allow certain individuals without qualifying children to claim the credit.

2019 Maryland Code Tax - General Title 10 - Income Tax Subtitle 7 - Income Tax Credits 10-704. Your employees may be entitled to claim an eitc on their 2019 federal and maryland resident income tax returns if both their federal adjusted gross income and their earned income is less than the following. The earned income tax credit or.

Applying the Act to taxable years beginning after December 31 2018. Maryland earned income tax credit 2019. If you qualify for the federal earned income tax credit and claim it on your federal return you may be entitled to a Maryland earned income tax credit on the state return equal to 50 of the federal tax credit.

Allowable Maryland credit is up to one-half of the federal credit. For 2019 the maximum Earned Income Tax Credit per taxpayer is. The Earned Income Tax Credit EITC is a benefit for working people with low to moderate income.

30 1 i the numerator of which is the maryland adjusted gross income of 31 the individual. The state eitc reduces the amount of maryland tax you owe. PdfFiller allows users to edit sign fill and share all type of documents online.

I have a client whose domicile is state of md but he has resided and worked in foreign country from 2019. Ad Download or Email MD 502D More Fillable Forms Register and Subscribe Now. This alert addresses changes brought by passage of Chapter 40 of the Acts of 2021 concerning Income Tax Child Tax Credit and Expansion of the Earned Income Credit.

Some taxpayers may even qualify for a refundable Maryland EITC. Or 21 ii the State income tax for the taxable year. The RELIEF Act also enhances the Earned Income Tax Credit for these same 400000 Marylanders by an estimated 478 million over the next three tax years.

The state EITC reduces the amount of Maryland tax you owe. The allowable Maryland credit is up to one-half of the federal credit. The local EITC reduces the amount of county tax you owe.

Its free to sign up and bid on jobs. Allowable Maryland credit is up to one-half of the federal credit. MD Tax-Gen Code 10-704 2019.

To be eligible for the federal. Altering the calculation of the Maryland earned income tax credit to allow certain individuals without qualifying children to claim an increased credit. And applying the Act to taxable years beginning after.

Allowing certain individuals to claim a refund of the credit. Altering the calculation of the Maryland earned income tax credit to allow certain individuals without qualifying children to claim an increased credit. 2019 Maryland Earned Income Tax Credit EITC Marylands EITC is a credit for certain taxpayers who have income and have worked.

In addition the legislation increases the refundable Earned Income Tax Credit to 45 for families and 100 for individuals. Allowing certain individuals to claim a refund of the credit. For earned income For earned income Universal Citation.

529 with no Qualifying Children 3526 with one Qualifying Child 5828 with two Qualifying Children 6557 with three or more Qualifying Children See all of the latest requirements for the EITC or Earned Income Tax Credit. Search for jobs related to Maryland earned income tax credit notice 2019 or hire on the worlds largest freelancing marketplace with 20m jobs. Providing that the amount of the credit that may be claimed by certain individuals is adjusted for inflation each year.

Taxpayer Services TSD Alcohol Tobacco Commission ATC Bureau of Revenue Estimates BRE Central Payroll Bureau CPB Office of Communications OOC Compliance Division CD Office of Administration and Finance A F. Providing that the amount of the credit that may be claimed by certain individuals is adjusted for inflation each year. It discusses the additional taxpayers eligible to claim the Maryland Earned Income Credit s and the requirements for claiming the Child Tax Credit.

50162 55952 married filing jointly with three or more qualifying children 46703 52493 married filing jointly with two qualifying. Allowing certain individuals to claim a refund of the credit. Capture Your W-2 In A Snap And File Your Tax Returns With Ease.

To be eligible for the federal and Maryland EITC your federal adjusted gross income and your earned income must be less than the following. The Maryland earned income tax credit EITC will either reduce or. Most taxpayers who are eligible and file for a federal EITC can receive the Maryland state and local EITC.

Reduces the amount of Maryland tax you owe. 50162 55952 married filing jointly with three or more qualifying children 46703 52493 married filing jointly with two qualifying children. Qualify to receive some of these credits even if you did not earn enough income to be required to file a tax return.

In 2019 86000 Maryland workers paid taxes this way and 60000 of them had incomes low enough that they would have qualified for the tax credit if allowed. 18 i 50 of the earned income credit allowable for the taxable year 19 under 32 of the Internal Revenue Code OR THAT WOULD HAVE BEEN ALLOWABLE BUT 20FOR THE LIMITATION UNDER 32MOF THE INTERNAL REVENUE CODE.

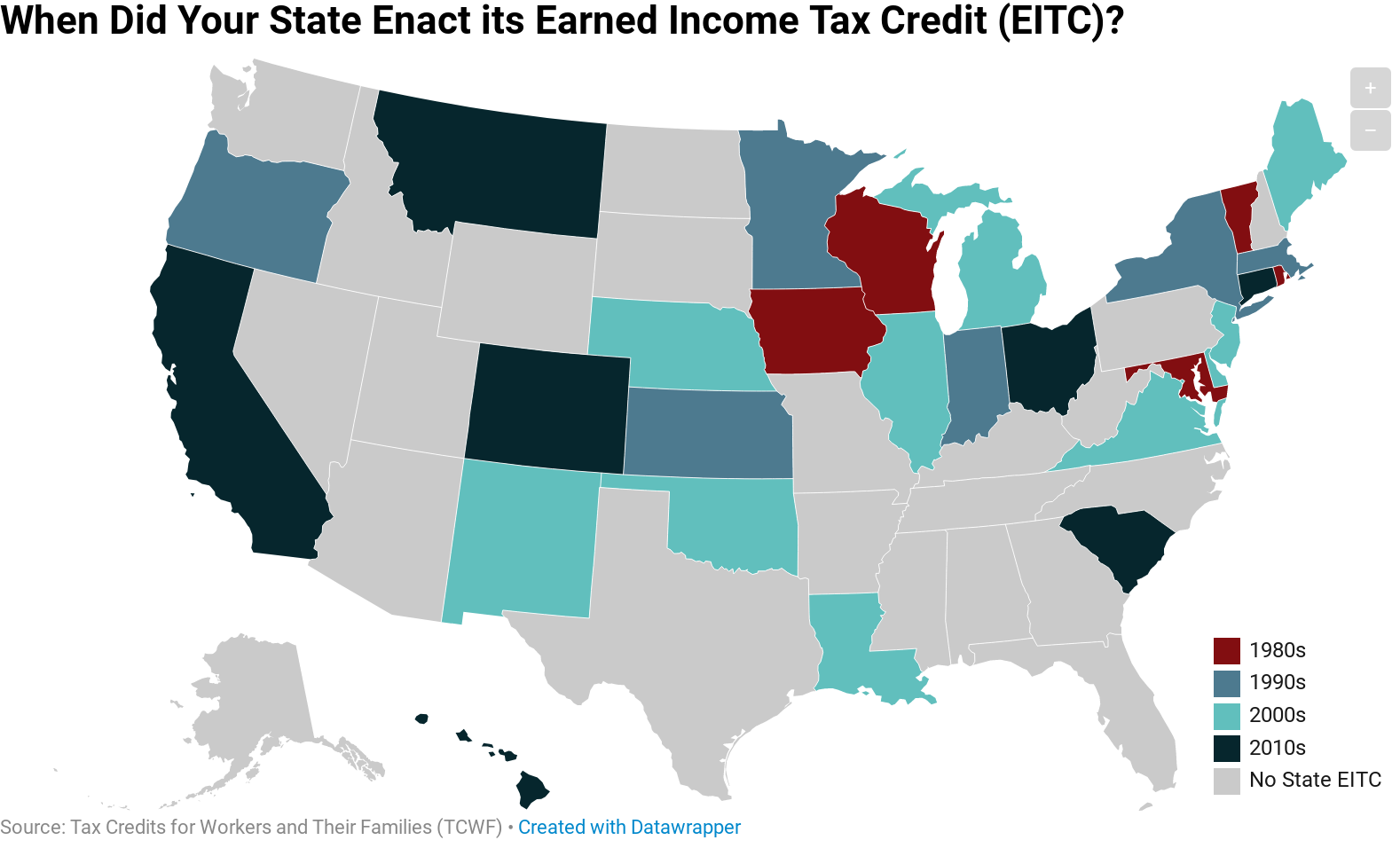

When Did Your State Enact Its Eitc Itep

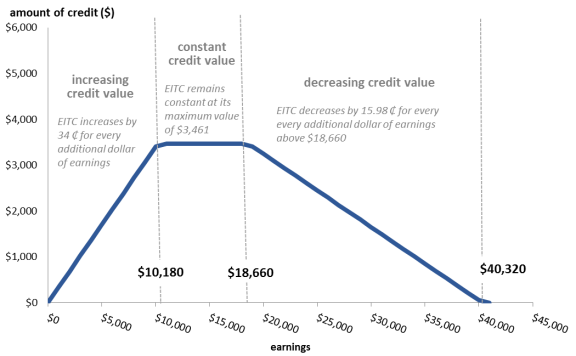

Earned Income Tax Credit Eitc Tax Credit Amounts Limits

Does Virginia Washington Dc Or Maryland Have The Most Favorable Taxes Eli Residential Group

Earned Income Credit H R Block

How Does The Deduction For State And Local Taxes Work Tax Policy Center

Details Of House Democrats Cash Payments And Tax Credit Expansions Itep

The Earned Income Tax Credit Eitc Administrative And Compliance Challenges Everycrsreport Com

Details Of House Democrats Cash Payments And Tax Credit Expansions Itep

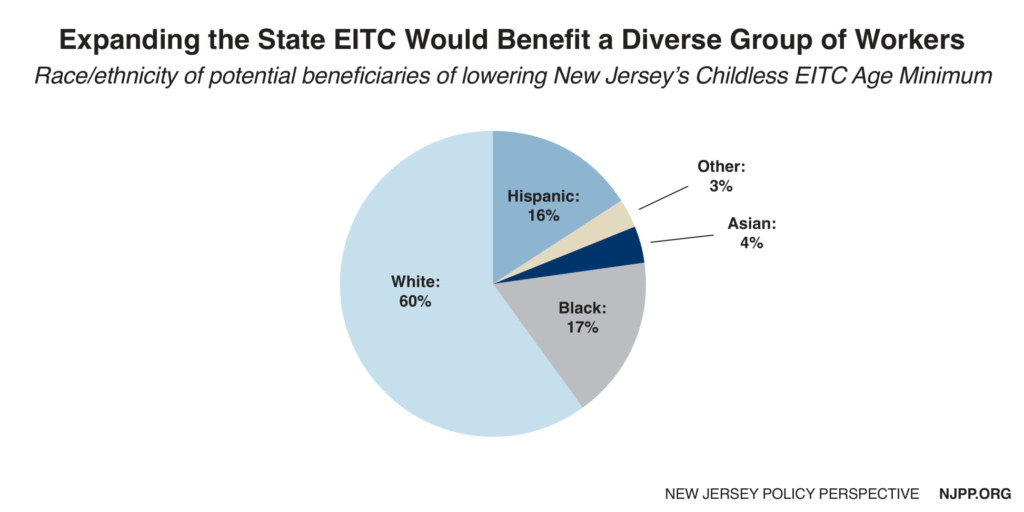

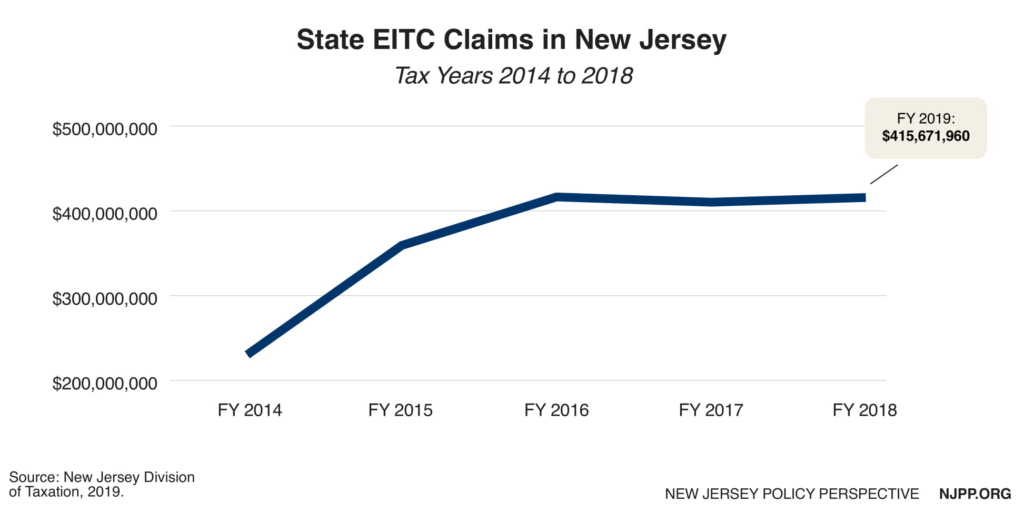

Prosperity For All Expanding The Earned Income Tax Credit For Childless Workers New Jersey Policy Perspective

Maryland Relief Act What You Need To Know Mvls

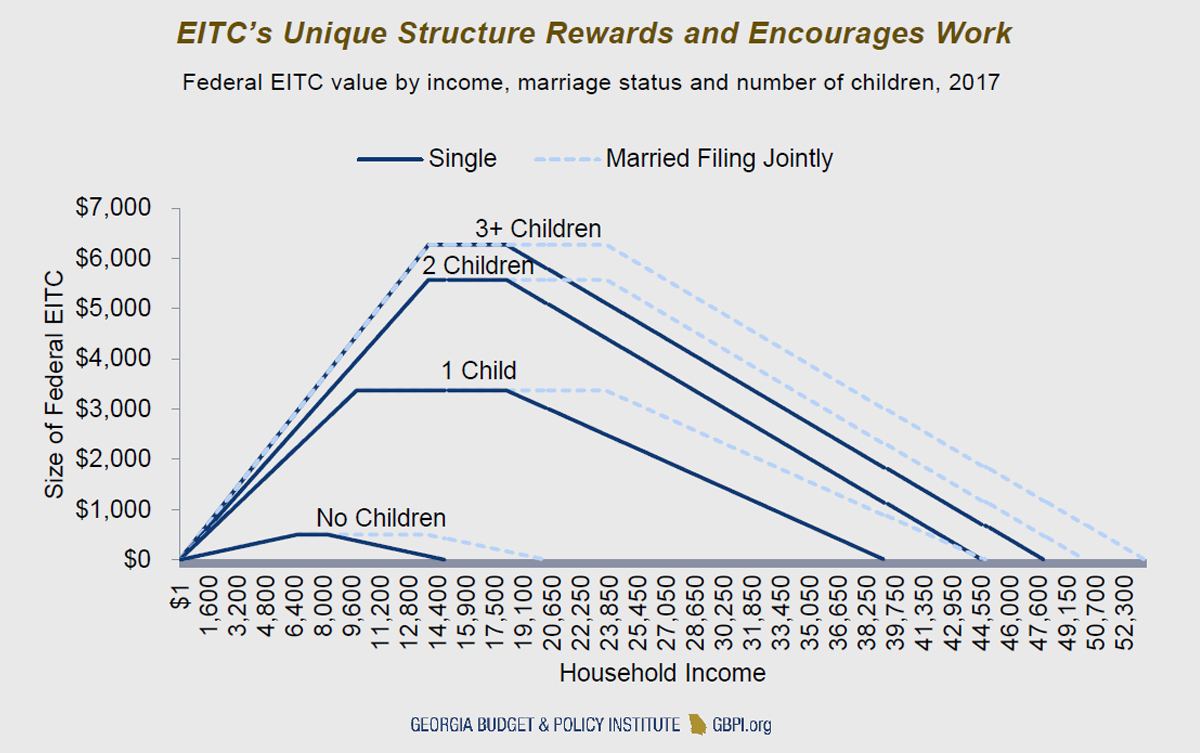

The Earned Income Tax Credit And Young Adult Workers Georgia Budget And Policy Institute

Summary Of Eitc Letters Notices H R Block

Table 1 From The Earned Income Tax Credit Eitc Percentage Of Total Tax Returns And Credit Amount By State Semantic Scholar

Filing Maryland State Taxes Things To Know Credit Karma Tax

Eligible Taxpayers Can Claim Earned Income Tax Credit Eitc

Prosperity For All Expanding The Earned Income Tax Credit For Childless Workers New Jersey Policy Perspective